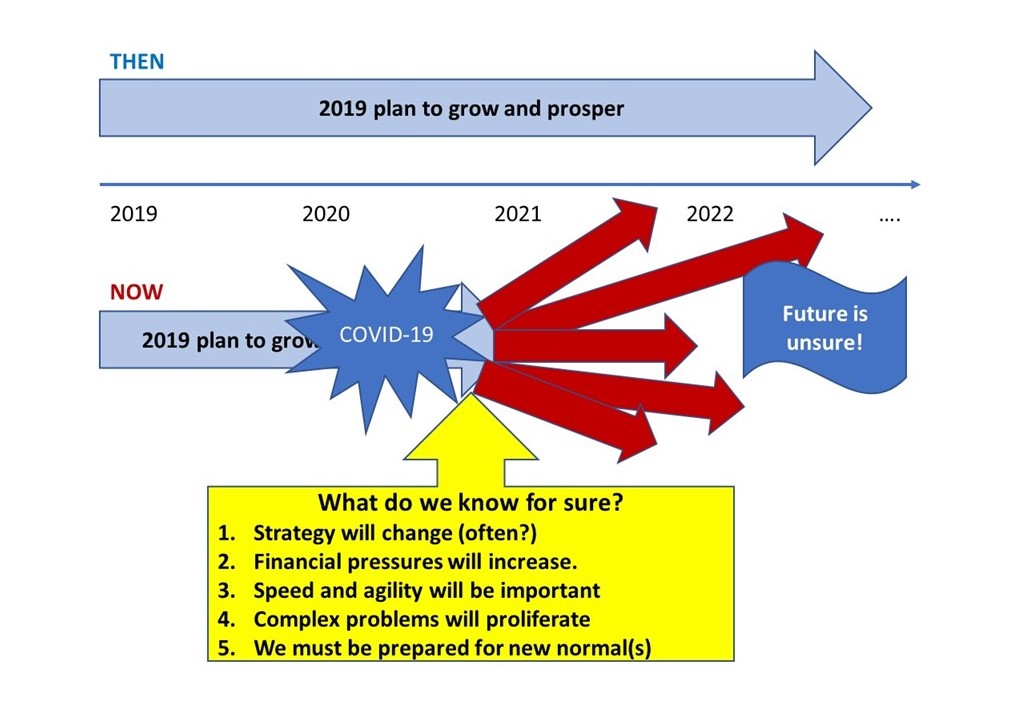

WHAT WE KNOW FOR SURE – Part 3 – Financial Pressure

We posted COVID, STRATEGY, AND WHAT WE KNOW FOR SURE about a week ago. Here are some further comments and observations about the second “known.”

Gee, about a year ago, things were simple. Put together a good strategy and ride it into the future. Sweet!

BAM! COVID-19! >>>>> FINANCIAL PRESSURE WILL INCREASE!

OK, it’s obvious that financial pressures have and will increase. The question you might want to dig into is “So, how much should I, a non-expert but an up-and-coming leader, need to know?”

See if the following list list makes you nervous. If so, start learning just a wee bit more about the magic stuff (money) that keeps your business running.

Profit and Loss Statement

- Net Sales

- Cost of Goods Sold

- Merchandise/Product Margins

- Net Profit

- Cash vs. Non-Cash Items

- Accrual Reporting vs. Cash Reporting

- Variance Analysis

- Are you really making money? How much profit does the company make on $1 of revenue?

Balance Sheet

- Types of Assets

- Types of Debt

- Owners Equity

Cash Flows

- Operating

- Investing

- Financing

Meaning of Basic Financial Ratios

- DuPont ROE Model

- Return on Investment

- Return on Sales

- Return on Assets

- Impact of Leverage/Borrowing

Budgets

- How to Budget

- Variance Analysis

Don’t get snowed as the world changes around you. Financial literacy is needed at ALL levels of leadership.

Never miss out!

Get an email update every time I publish new content. Be the first to know!