A Middle Manager’s Guide to Finance – 1

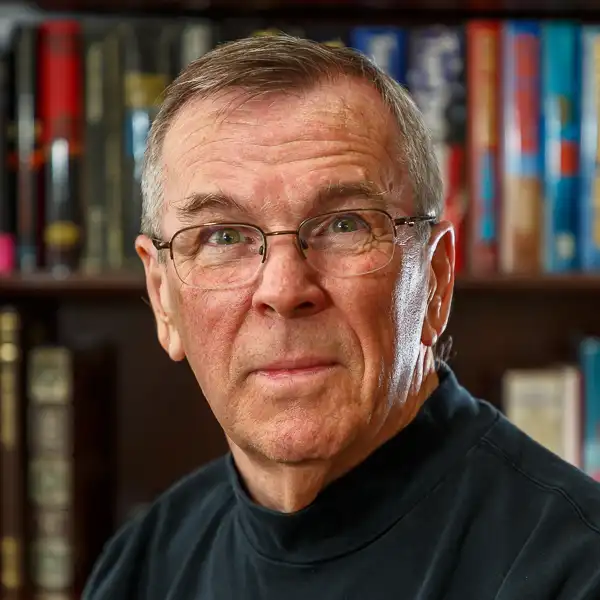

Ken Vermilion

3/8/2020

Understanding the world of corporate finance in a big company can be daunting. And if you’re not in the management chain that ends with the Chief Finance Officer (CFO), you might wonder if middle managers really need to bother themselves with the language, strategic thinking skills and, perhaps the most daunting, the math of corporate finance?

The answer may be “no” if you’re comfortable in your middle management position and don’t aspire to move up the ranks or know that your job will never be eliminated. (Note: I don’t believe the last situation exists anywhere in corporations today. Do you?)

Wouldn’t it be nice to understand the fundamentals of finance enough to be able decode the CFO’s presentation to shareholders at the annual meeting or the written analysis reported in the company’s annual report, to understand what your finance manager’s thinking about regarding your piece of the business, or to know how your work fits into the overall financial success of the company? I’m going to go out on a limb and say “yes”, you would like to understand the fundamentals, but in terms applicable to your position in the company and in terms you can easily digest.

The goal of this blogging series is to present the fundamentals of finance in a format suitable for non-financial managers interested in learning more about financial management in order to help them advance in their careers. (Note: Heck, your newfound knowledge and language might make you a candidate to participate in future strategic action planning exercises!)

You will pick up the fundamental language of finance and be better positioned to understand what makes your company tick, financially. Most importantly, you will be positioned to know how your activities contribute to the financial goals of the company and be able to ask important/thoughtful questions about your department’s financial performance. Your understanding of fundamental finance will assist you in developing the skills needed to “lead from the middle.”

For a start, you will learn about the importance of cash (some things obvious and some things not so obvious), the fundamental financial statements and how they integrate, an analytical framework for comparing elements of the financial statements to determine how the business is doing, basic financial analysis that can help in complex problem identification/solving, and how I like to read through annual reports. You will also be able to ask me questions to help further clarify concepts. Together, we can expect to have some fun with finance. And I promise never to use a lemonade stand or fruit vendor to make a point, not that there is anything wrong with doing so.

So, stay tuned to this space to prepare you for the future. Use the reply button to actively participate in the journey this blog can provide you!

Career Momentum Builder – I will close each blog post with a Career Momentum Builder. The builder may simply be something to think about in the context of your job accountabilities. Or a very short, emphasis on very, assignment that relates to the current blog or the blog post that will appear next. The MindPrep Resource Center was formed with one goal in mind: to help emerging leaders progress and succeed in their careers. This blog is driven by that commitment.

Never miss out!

Get an email update every time I publish new content. Be the first to know!